Quality Professional Service

Customized solutions

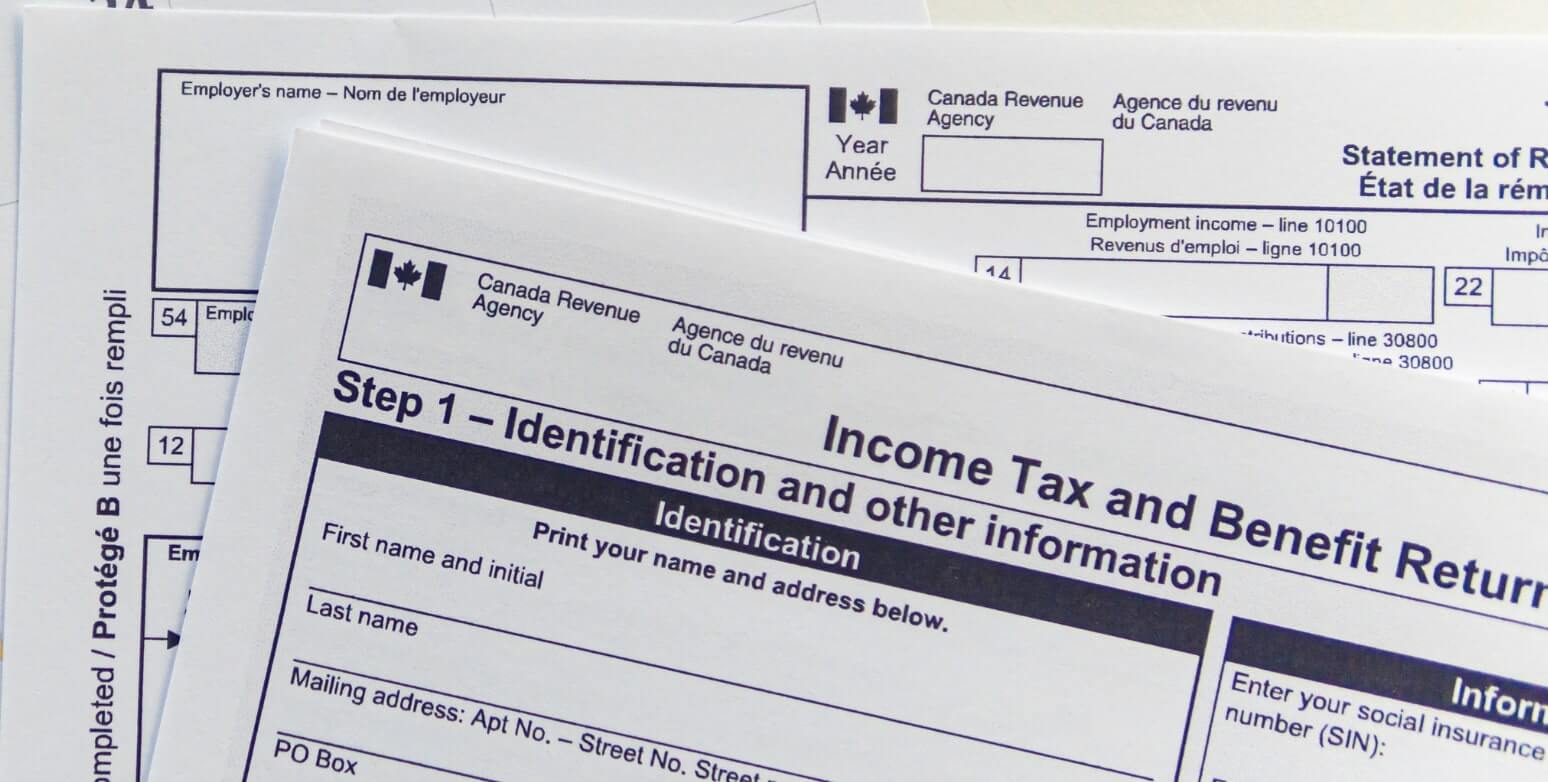

There are many reasons for engaging a Chartered Accountant. For many it may simply be at tax

time to file a corporate and/or individual tax return. For others, it may be for financial

statement preparation (Notice to Reader report), or for an audit or review that your bank or

regulatory body may have asked for. MMT can assist you or your company with these services and

can provide other business advisory services to help your business achieve its goals.

Advisory

- - Financial planning and forecasting

- - Cash flow projections

- - Business plan preparation

- - Outsourced CFO services

- - Transaction advisory – buying or selling a business

- - Global Investment Performance Standards – consulting and verification services

- - Payroll services

- - Accounting advisory

- - Other customized accounting and finance solutions

Personal and corporate tax planning and compliance CRA dispute resolution

Being a responsible citizen of your country Tax is mandatory on you and should be paid accordingly as well. Whether you are an individual or an organization whether big, small or global. There always a challenge you can face while trying to file out your tax reports while dealing with multiple money markets we often miss out somethings from the Tax that is where we have got you covered.

Preparation of Notice to Reader

A financial statement of compilation is compiling of financial segments and finance routing documents of a business or a company from an external auditor where it is kept in mind to prepare those statements in a manner that they do comply with standards set by accounting authorities...

Audit or review of financial statements

Assurance is a service provided to make sure that the financial statements that are being presented in court of law or Federal board of revenue are backed with correct figures and analysis so that everything is kept in record and is trouble free. Where no objection should arise in any form.

Our Story

Matthew has over 15 years’ experience working on Bay Street in Toronto in the financial services sector. He began his career at a Schedule 1 bank and quickly moved onto a Big 4 accounting firm. While at the firm, he earned his professional designations while providing assurance, advisory and tax related services to a diverse client base with a focus on investment management clients.

After leaving the firm, Matthew joined a Schedule 1 bank working in finance and then the trading floor. Matthew now leads the strategic direction of MMT and helps clients navigate through reporting, tax, advisory and accounting issues west of the city.

A graduate of the University of Toronto, Matthew is a Chartered Professional Accountant (“CPA”), Chartered Accountant (“CA”) and member of CPA Ontario; a Certified Public Accountant and member of the AICPA; and a Chartered Financial Analyst (“CFA”) charterholder (CFA Institute). Matthew is also on the Board of Directors of Canpak Health and Education Foundation, a CRA registered charity.